Get This Report about Irs Nonprofit Search

Wiki Article

501c3 Organization Can Be Fun For Everyone

Table of ContentsThe Greatest Guide To Irs Nonprofit SearchThe Best Guide To 501c3A Biased View of Non Profit Organizations ListNonprofits Near Me - The FactsThe smart Trick of Npo Registration That Nobody is Talking AboutThe Single Strategy To Use For Google For NonprofitsThe Of Non Profit Organizations Near MeThe Greatest Guide To Non Profit OrgThe 9-Minute Rule for Non Profit Organizations Near Me

Integrated vs - 501c3. Unincorporated Nonprofits When people think about nonprofits, they typically consider incorporated nonprofits like the American Red Cross, the American Civil Liberties Union Structure, as well as other formally created companies. Nonetheless, many individuals take component in unincorporated nonprofit organizations without ever understanding they've done so. Unincorporated nonprofit organizations are the outcome of two or even more individuals working together for the function of giving a public benefit or solution.Personal foundations might consist of family structures, personal operating structures, as well as company structures. As kept in mind above, they typically do not provide any kind of services and rather use the funds they elevate to sustain other philanthropic companies with solution programs. Exclusive structures also tend to need even more startup funds to establish the company along with to cover lawful fees as well as various other ongoing expenditures.

5 Simple Techniques For Non Profit Org

The assets stay in the trust while the grantor is active and also the grantor might take care of the possessions, such as getting and marketing stocks or real estate. All possessions transferred right into or bought by the trust fund remain in the count on with income distributed to the designated beneficiaries. These trust funds can survive the grantor if they include an arrangement for recurring management in the documentation made use of to establish them.

An Unbiased View of Nonprofits Near Me

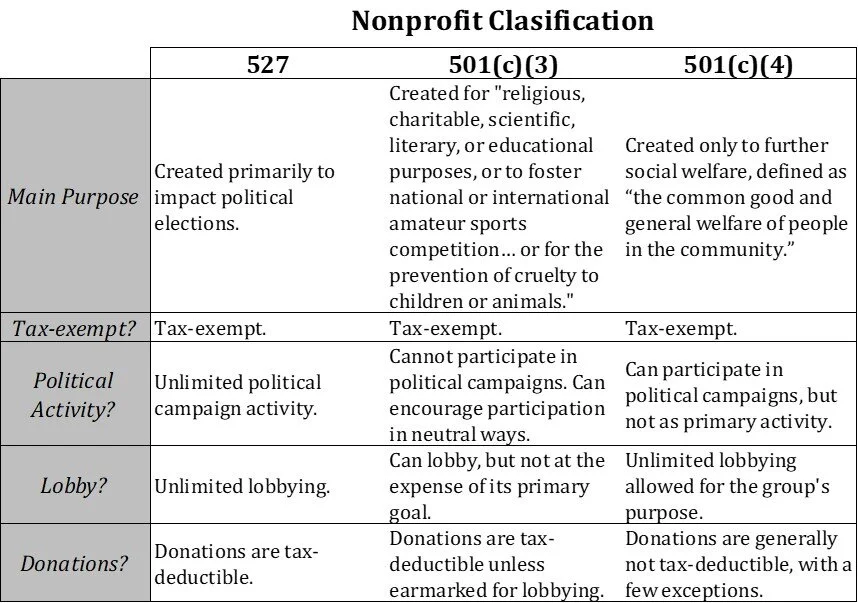

Alternatively, you can employ a trust fund lawyer to aid you produce a charitable trust fund as well as recommend you on exactly how to handle it relocating forward. Political Organizations this contact form While the majority of various other kinds of not-for-profit organizations have a limited ability to get involved in or advocate for political activity, political organizations operate under various rules.

The Ultimate Guide To 501c3 Organization

As you examine your alternatives, make certain to seek advice from with a lawyer to determine the most effective method for your organization as well as to ensure its correct configuration.There are many kinds of nonprofit companies. These nonprofits are normally tax-exempt since they pursue the public interest. All properties and earnings from the nonprofit are reinvested into the company or given away. Relying on the nonprofit's subscription, objective, as well as structure, various classifications will use. Nonprofit Organization In the USA, there are over 1.

Get This Report on Irs Nonprofit Search

Some instances of widely known 501(c)( 6) organizations are the American Ranch Bureau, the National Writers Union, and the International Organization of Meeting Planners. 501(c)( 7) - Social or Recreational Club 501(c)( 7) companies are Continue social or leisure clubs.

Npo Registration Fundamentals Explained

Usual incomes are subscription charges and also contributions. 501(c)( 14) - State Chartered Lending Institution and Mutual Reserve Fund 501(c)( 14) are state chartered lending institution and also shared get funds. These organizations supply financial solutions to their participants as well as the area, commonly at affordable prices. Income sources are company activities and also government grants.In order to be qualified, a minimum of 75 percent of participants have to be present or past members of the United States Army. Financing comes from contributions and also government gives. 501(c)( 26) - State Sponsored Organizations Offering Wellness Protection for High-Risk Individuals 501(c)( 26) are not-for-profit companies produced at the state degree to provide insurance coverage for high-risk individuals that may not be able to get insurance with other means.

Non Profit Organization Examples Things To Know Before You Buy

501(c)( 27) - State Sponsored Workers' Payment Reinsurance Organization 501(c)( 27) not-for-profit companies are produced to offer insurance for workers' compensation programs. Organizations that supply workers compensations are called for to be a participant of these companies and also pay charges.A nonprofit company is a company whose objective is something More Bonuses various other than making a revenue. 5 million nonprofit organizations registered in the United States.

Not known Factual Statements About Nonprofits Near Me

Nobody person or team has a nonprofit. Assets from a not-for-profit can be offered, however it profits the entire company instead of individuals. While anybody can integrate as a nonprofit, just those that pass the rigorous standards established forth by the government can attain tax obligation exempt, or 501c3, status.We discuss the actions to becoming a nonprofit more into this page.

Irs Nonprofit Search Fundamentals Explained

The most vital of these is the ability to acquire tax "excluded" status with the IRS, which enables it to obtain contributions without gift tax obligation, enables donors to subtract donations on their revenue tax returns and also excuses a few of the organization's tasks from income tax obligations. Tax obligation excluded status is critically important to many nonprofits as it motivates contributions that can be used to sustain the objective of the company.Report this wiki page